Posts by access

The Consumer Credit Panorama in 2022

Are you worried about the state of your credit? You’re not alone in a world where technology changes by the day. It’s hard to keep track of what constitutes “good credit” and what could potentially damage your score. Whether you’re looking to buy a house or want to keep your options open, understanding consumer solvency…

Leer másDebt Collection FAQ

To help our readers understand the basics of this practice, we have created this article to address some debt collection FAQ. Debt Collection FAQ Below, you’ll find a debt collection FAQ to guide you through this practice. Don’t hesitate to contact us if you have any more doubts! Q1. What is a debt collector? It…

Leer másUnited States Demographics of Debt

According to recent information published in reports, more than 300 million Americans are indebted to creditors; the pandemic’s impact is responsible for the bulk of this record high. According to experts, it is the highest annual spike in over a decade. Credit can be good for those trying to build their credit history and score,…

Leer másHow to Manage Credit Card Debt

Getting your debt under control will require focus from several different directions. Controlling what you spend, tracking your total debt by account, interest rate, and minimum payment will take detailed attention. However, once you start, the process will move along quickly! Understand What You Owe Getting your credit card debt under control starts will…

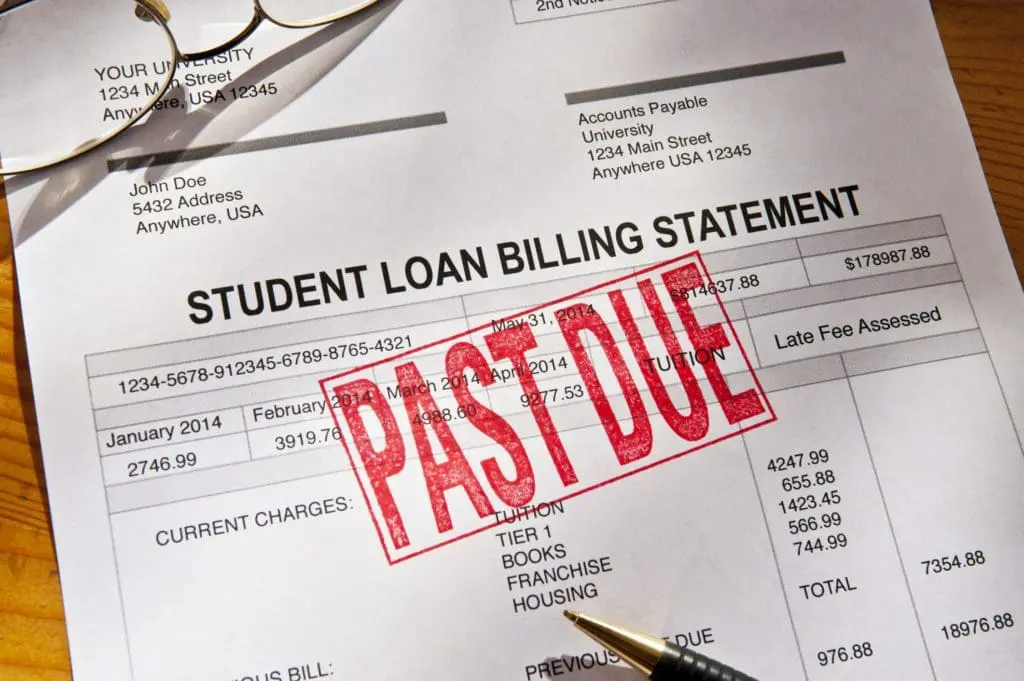

Leer másThe Student Loan Crisis Is Growing

A student loan crisis is raging in the United States, with dire consequences for students and the economy. With the average student spending over $30,000 on educational debt, a significant increase from $10,000 in the early 1990s, the situation continues to deteriorate. This increase is due to the skyrocketing cost of higher education, which has…

Leer másStep by Step: What to Do if You Don’t Recognize Debt

Did you know that collection agencies purchase debts for pennies on the dollar and then try to collect as much money as they can to make a profit? Sometimes, these companies want payments, but they also want to scare people into giving them even more than what was initially owed to make more money. Knowing…

Leer másCan You Go to Jail for Debt?

You cannot be arrested solely for owing money on what is known as consumer debt, such as a credit card, student loan, or medical bill. Collectors cannot even intimidate you with arrest. However, they have additional legal options, such as threatening to sue you for payment. Also, in some instances, debts can result in arrest…

Leer másWallet Hub Credit Card Debt Study

WalletHub recently published a report earlier this month highlighting showing how credit card debt is increasingly becoming a thorn in the side for U.S. consumers. It captures how many Americans’ successes in paying down their balances in 2020 didn’t stick. Consumers instead took on record-high debt during 2021. Evidence suggests that assuming it is becoming…

Leer másA Complete Guide to Debt Settlements

Starting with bad news is never fun. However, it is essential to know that in 2020, the average U.S. consumer debt reached new record levels. Outstanding consumer debt increased to just under $14.9 trillion as the U.S. economy struggled with the outbreak of the coronavirus pandemic. How bad is the average consumer debt in 2020? It is…

Leer másWhat Is Debt Consolidation?

The average American is walking around with more than $90,000 in debt. This number includes consumer debt products, from mortgages and credit cards to personal loans and student debt. While taking on debt is considered a viable financial strategy in this day and age, it can also take a severe toll on you. If you have…

Leer más