Debt Studies

Generation Z Spending Habits

Although most Generation Z hasn’t reached employment age, they influence the spending habits in modern homes by a great deal. Generation Z has more spending power than other generations. Zoomers monitor their spending habits, know where and how to shop, and are keen on the prices. Let’s dig into Generation Z’s spending habits. What is Generation…

Leer másMillennial Spending Habits

Millennials are very different from prior generations in many ways, which makes millennial spending habits peculiar. When it comes to their finances, they seem to be more interested than their parents and grandparents in using their money in ways that may benefit causes close to their hearts. So, they were more likely to buy from…

Leer másUnited States Demographics of Debt

According to recent information published in reports, more than 300 million Americans are indebted to creditors; the pandemic’s impact is responsible for the bulk of this record high. According to experts, it is the highest annual spike in over a decade. Credit can be good for those trying to build their credit history and score,…

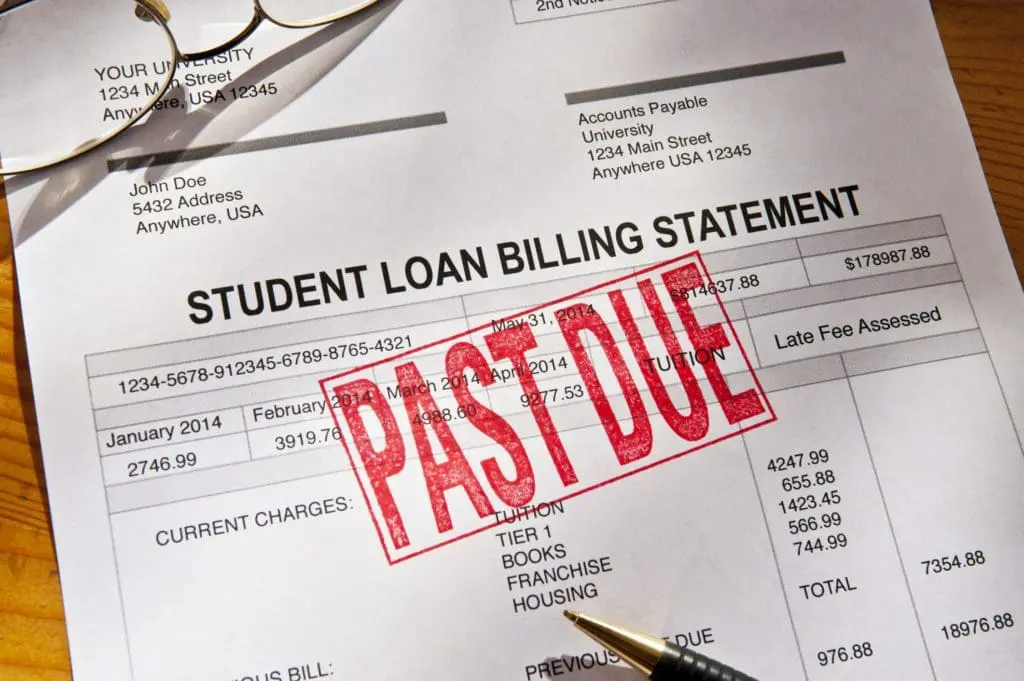

Leer másThe Student Loan Crisis Is Growing

A student loan crisis is raging in the United States, with dire consequences for students and the economy. With the average student spending over $30,000 on educational debt, a significant increase from $10,000 in the early 1990s, the situation continues to deteriorate. This increase is due to the skyrocketing cost of higher education, which has…

Leer másWallet Hub Credit Card Debt Study

WalletHub recently published a report earlier this month highlighting showing how credit card debt is increasingly becoming a thorn in the side for U.S. consumers. It captures how many Americans’ successes in paying down their balances in 2020 didn’t stick. Consumers instead took on record-high debt during 2021. Evidence suggests that assuming it is becoming…

Leer más