How to Manage Credit Card Debt

Getting your debt under control will require focus from several different directions. Controlling what you spend, tracking your total debt by account, interest rate, and minimum payment will take detailed attention. However, once you start, the process will move along quickly!

Understand What You Owe

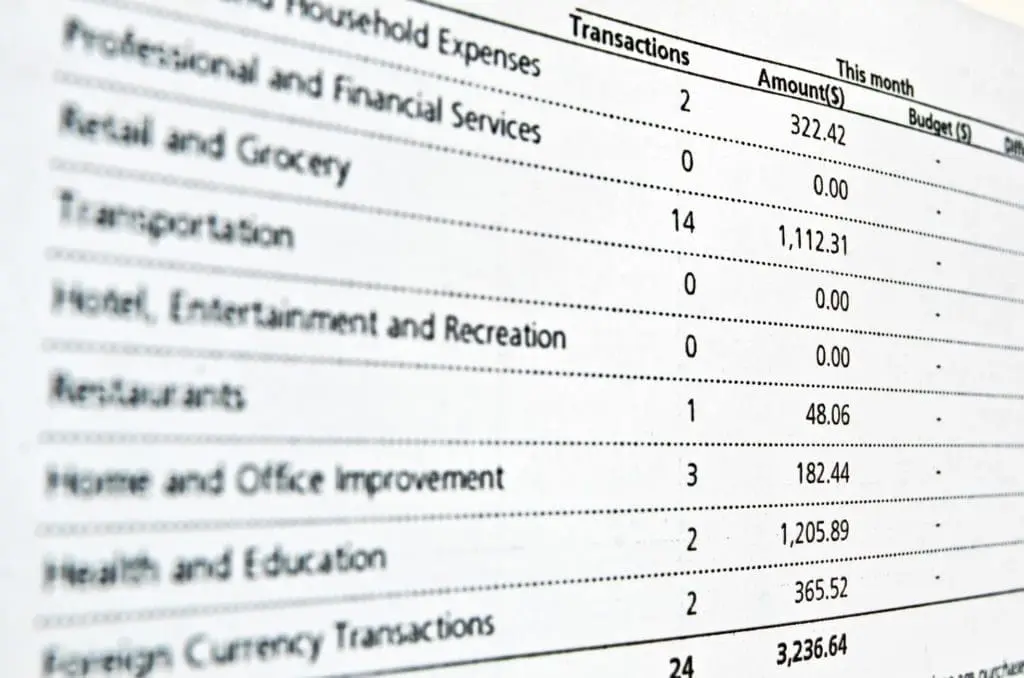

Getting your credit card debt under control starts will be easier to set up a basic spreadsheet. On this spreadsheet, list:

- the company you owe

- the total debt

- the interest rate

- the minimum payment

If you’re living check to check, only paying the minimum but staying afloat, you may choose the snowball method. Using the snowball method, sort your spreadsheet by total debt. Make the minimum payment on everything else and dump anything extra on the smallest debt. When you get the smallest debt wiped out, roll or snowball the payment to the next smallest debt.

Managing Debts Will Be Easier Once You Get The Interest Under Control

Consider using the avalanche method if you’re drowning in debt and can’t make the minimum. Sort your spreadsheet by interest rate, from largest to smallest, and put as much money as possible on the highest interest rate.

Make sure you reach out to your creditors and get those interest rates lowered. If you enter credit repair counseling, you may be able to get consumer protection from your counselor to bargain for a better rate. Update the spreadsheet and sort your data again.

Fighting “Payment Poverty”

If you’re working as hard as you can but find yourself struggling with monthly debt payments. Sort your spreadsheet by minimum payments from largest to smallest. Once you get interest rates under control and as low as possible, you can start putting all the extra cash you can find against the debt with the most significant payment.

Once that debt is retired, and you have a bit more flexibility, you can go back and choose either the snowball or the avalanche method so you can keep going.

Plan a Hard Reset

A simple form of debt education that you can do alone is to do a no-spend. You can do these for short periods; for example, a three-day no-spend can start on a Friday morning. For three days, eat out of the pantry. Find free stuff to do with friends and family. Pack a picnic, try a new recipe, or work on decluttering a pesky space in your home.

Since you didn’t shop over the weekend, you can inventory your cupboards, refrigerator, and freezer and do a grocery shop fill-in with a detailed list—the next goal is to plan for a 10-day no-spend.

Pull From Equity

If you own your home or vehicle, consider checking their value now. A paid-for car can be refinanced to cover other debts if you refinance through a bank that you have a good relationship.

You may be able to pull cash out of your home to pay down high-interest debt as well. If you’re considering this, rank your debts by total owed.

Once you know the total amount you can get out of your home or car, pay off as many small debts as possible. This is a quick way to raise your credit rating; having a card with no debt on it reflects well on your creditworthiness. Give it a month, then call those zero balance cards to see if they offer you a balance transfer loan.

Give it another month if you can’t get a 0% APR balance transfer from an existing card. You will probably start to get offers from new cards. When reviewing these new cards, go for the longest terms you can get with 0% interest. Sort your list by highest interest rate and roll a portion of the highest interest debt onto the new card. Next, sort by total owed and use the snowball method.

Of course, moving debt to a 0% APR card is still debt. Additionally, if you borrow as much as you can, it’s maxing out a credit card. However, if you can create a bit of breathing room in the balances of more than one other card, it can still be better for your overall credit picture.

Know and Track the Terms of Your 0% APR Cards

Divide the total debt by the terms in months. If you owe $4,000 on a new card and have to pay it off in 18 months, you need to pay about $225 per month to wipe out the debt. This payment may seem easier to cover if you submit a payment each payday. With two people working in the house, this can turn out to be four payments a month.

No matter what, make sure you pay off that card within the 0% APR terms. If it looks like you’re not going to make it, give yourself a month to find another card to which you can move that debt. It is possible to bounce debt back and forth from a card that doesn’t have a balance. However, the timing of this can be stressful.

Protect Your Credit Rating

Several factors can impact your credit rating. The three that are the easiest to control are

- paying at least the minimum on time, which can also save late fees

- not maxing out your credit cards, which is why rolling a portion of your existing debt onto a new card can help

- having a variety of secured and unsecured debt, which is why refinancing a house or car can improve your score

Working with a not-for-profit credit counseling service is the best way to target credit repair if your record has a few rocky patches.

Pair Budget and Savings

If you don’t yet have a budget, build it from the history of your purchases. Imposing a budget without history will be too restrictive and may lead to a binge. Even if you were spending more than you made, gather up data from your spending history and use this tool to target your savings goals.

For example, if your grocery budget was $50 a week, start by saving up $50. Once you reach that, save up enough to cover a car payment. Next up, maybe utilities. If your rent was $1,000 a month, work toward saving up $1,000. Once you know your budget, you can create an emergency fund that will keep you housed and fed for at least a month if things fall apart.

Increase Your Income

Finally, if you take on another job to beat credit card debt, set up a different bank account, and route all funds from that job into this special account. Please make sure you value your time when getting another job. If you have to give up your Friday and Saturday evenings and make $100 each night but wind up going to a restaurant because you’re starving and don’t want to cook, you may end up burning that extra income and lose the time you could have spent with your family.

Taking on a second job may be a great choice if two adults in the household can share the home chores. However, it may be possible to save $200 a week if you stay home and focus on cutting back your spending.

Credit card debt doesn’t have to be a prison sentence that keeps you chained to your job. Getting creative with ways to cut expenses is a skill set that can save you a great deal of money throughout your life.

When facing challenges with debt, it is very important to educate yourself. You can find more information on our debt education page.