Building a Winning Case: Essential Evidence for Your Debt Harassment Lawsuit

When debt collectors cross the line from legitimate collection efforts into harassment, consumers have the right to fight back through legal action under the Fair Debt Collection Practices Act (FDCPA). However, winning a debt harassment lawsuit requires more than knowing your rights; it demands compelling evidence demonstrating the collector’s violations. Building a strong case begins with understanding what evidence courts find most persuasive and implementing systematic documentation strategies from when harassment begins.

The Consumer Financial Protection Bureau reports that debt collection complaints consistently rank among the top consumer grievances, with harassment-related violations representing a significant portion of successful FDCPA lawsuits. However, cases with substantial documentary evidence are far more likely to result in favorable settlements or court victories. Understanding how to gather, preserve, and present this evidence can mean distinguishing between a dismissed case and substantial monetary recovery.

The Foundation of Evidence: Documentation Strategies

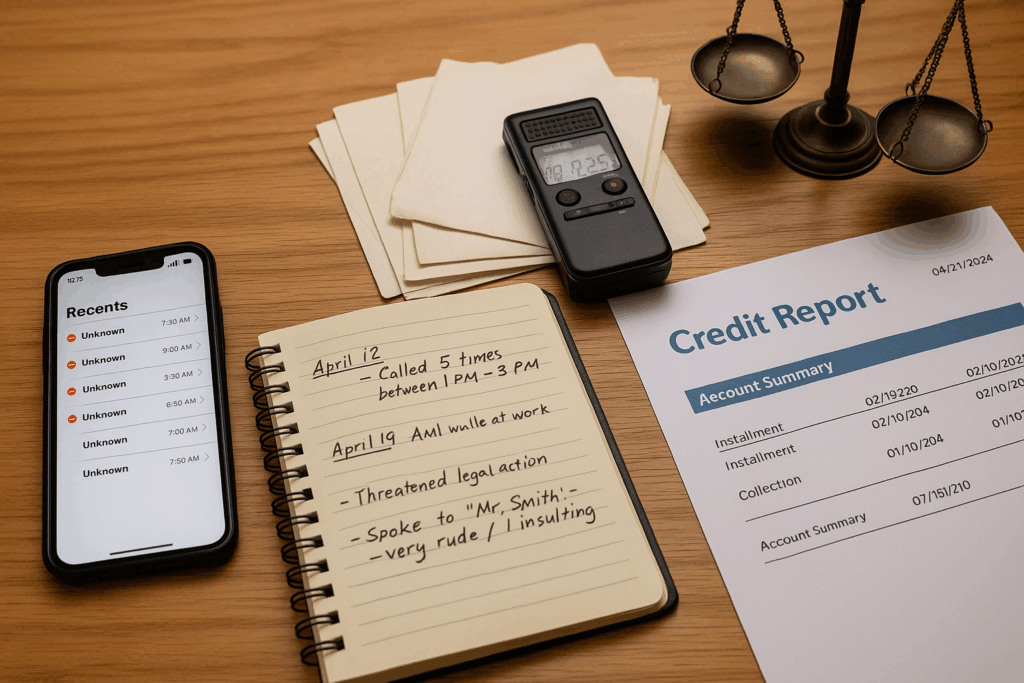

Successful debt harassment lawsuits are built on meticulous documentation, creating an undeniable record of collector misconduct. The Federal Trade Commission emphasizes that contemporaneous records, made at or near the time of the harassment, carry significantly more weight in legal proceedings than reconstructed timelines created after the fact.

Creating a Comprehensive Communication Log

Every interaction with debt collectors should be documented immediately after it occurs. The Consumer Financial Protection Bureau recommends maintaining a detailed log that includes the date and time of contact, the representative’s name, the collection agency’s name, a conversation summary, and any threats or inappropriate statements made.

Your communication log should capture what was said and how it was said. Courts recognize that harassment often lies not in the literal words used, but in the tone, frequency, and context of communications. Document aggressive language, raised voices, interruptions when you try to speak, and any statements that made you feel threatened or humiliated.

Include information about the impact of each contact. Did the call cause you to miss work? Did you experience physical symptoms like headaches or anxiety after the conversation? Did family members witness your distress? These details help establish the emotional and financial damages that form the basis of your claim.

Recording Phone Conversations Legally

Phone recordings provide the most potent evidence in debt harassment cases, but must be obtained legally to be admissible in court. The Federal Trade Commission notes that recording laws vary significantly by state, with some requiring consent from all parties and others allowing recording with only one party’s knowledge.

In one-party consent states, you can legally record conversations with debt collectors without informing them. However, you must be a party to the conversation; you cannot record calls between collectors and third parties. Research your state’s specific requirements, as violations of wiretapping laws can result in criminal charges and civil liability that far exceed any potential recovery from your harassment lawsuit.

If you live in a two-party consent state, you must inform the collector that you’re recording the call. While this may initially make collectors more cautious about their language, many will eventually revert to harassing behavior, providing you with legally admissible evidence of their violations.

Consider using dedicated recording apps or devices that automatically timestamp and store recordings securely. The Consumer Financial Protection Bureau emphasizes that proper preservation of recordings is crucial, as corrupted or altered audio files may be excluded from evidence.

Preserving Written Communications

All written communications from debt collectors should be preserved in their original form. This includes letters, emails, text messages, and social media communications. The Federal Trade Commission advises consumers to save original envelopes with postmarks, as these can help establish patterns of excessive communication or violations of time restrictions.

Take screenshots of digital communications showing metadata such as timestamps, sender information, and message threading. Print emails to PDF to preserve formatting and header information. Many harassment cases involve threats or inappropriate language that collectors later deny making, and having the original communication in multiple formats strengthens your credibility.

Create physical and digital copies of all communications, storing them separately to prevent loss. Consider using cloud storage services that maintain version history, allowing you to demonstrate that documents haven’t been altered since creation.

Digital Evidence in Modern Harassment Cases

Today’s debt collectors increasingly use digital platforms to contact consumers, creating new categories of evidence that can strengthen harassment lawsuits. The Consumer Financial Protection Bureau has noted a significant increase in complaints about harassment via text messages, emails, and social media platforms.

Text Message Documentation

Text message harassment has become increasingly common, and these digital communications provide excellent evidence because they’re automatically timestamped and difficult for collectors to deny. Screenshot each harassing text message, ensuring that the sender’s phone number, timestamp, and your phone’s signal strength indicators are visible.

Consider using apps that automatically back text messages to cloud storage or email accounts. This creates additional evidence that messages weren’t fabricated and provides backup copies if your phone is lost or damaged.

Document the frequency of text messages, as excessive texting can constitute harassment even if individual messages seem relatively benign. The Federal Trade Commission considers the overall communication pattern when evaluating harassment claims, making frequency documentation crucial.

Email and Social Media Evidence

Email communications from debt collectors should be preserved with full headers showing routing information, timestamps, and authenticity markers. Many email clients allow you to export messages in formats that preserve this technical information, which can be crucial if collectors claim messages were fabricated.

Social media harassment represents a growing category of FDCPA violations. Collectors who contact you through Facebook, LinkedIn, or other platforms may violate third-party disclosure rules if your connections can see the communications. Screenshot these interactions immediately, as collectors often delete violating posts once they realize their mistake.

Document any friend requests, direct messages, or public posts from collection agencies or employees. Even seemingly innocent contact through social media can violate FDCPA provisions if it reveals your debt to third parties or constitutes excessive communication.

Witness Testimony and Third-Party Evidence

Harassment often occurs in the presence of others, creating opportunities for witness testimony that can significantly strengthen your case. The Consumer Financial Protection Bureau recognizes that third-party witnesses provide independent verification of collector misconduct and can help establish the emotional impact of harassment.

Family Member and Household Witness Accounts

Family members who witness harassing phone calls or observe your emotional distress after collector contact can provide powerful testimony. Have them document their observations contemporaneously, including dates, times, and behaviors they witnessed.

Children who overhear threatening phone calls or see you crying after collector contact can provide particularly compelling testimony about the harassment’s impact on your family life. While courts are careful about involving minors in legal proceedings, their observations about changes in household atmosphere or your behavior can support emotional distress claims.

Document any instances where collectors contact family members inappropriately. The Federal Trade Commission prohibits collectors from discussing your debt with third parties except in minimal circumstances, and violations of these rules can significantly strengthen your harassment case.

Workplace and Professional Witnesses

Colleagues who observe the impact of harassment calls at work, supervisors who notice changes in your performance due to stress, or human resources personnel who document workplace disruptions can provide crucial evidence. The FDCPA prohibits workplace contact when collectors know your employer disapproves, making documentation of workplace harassment particularly valuable.

Keep records of any productivity losses, missed meetings, or workplace incidents related to debt collection harassment. If you receive disciplinary action or performance warnings related to collection calls disrupting your work, these documents become evidence of actual damages you can recover.

Medical and Mental Health Professional Documentation

Healthcare providers who treat stress-related symptoms caused by debt collection harassment can provide expert testimony about the connection between collector conduct and your physical or mental health impacts. The Consumer Financial Protection Bureau notes that medical documentation helps establish the severity of emotional distress damages in harassment cases.

Maintain records of all medical appointments, prescriptions, or treatments related to stress, anxiety, depression, or physical symptoms that began or worsened after harassment started. Your medical providers can testify about the timeline of symptoms and their professional opinion about causation.

Consider consulting with mental health professionals who specialize in financial stress and trauma. Their expert opinions about the psychological impact of debt collection harassment can help quantify emotional distress damages that might otherwise be difficult to prove.

Documenting Financial and Economic Damages

Beyond emotional distress, debt collection harassment often causes measurable financial harm that can be recovered in successful lawsuits. The Federal Trade Commission recognizes various categories of economic damages that harassment victims can claim, but these require careful documentation to prove.

Lost Wages and Employment Impact

Document any time missed from work due to harassing phone calls, court appearances related to collection efforts, or medical appointments for stress-related conditions. Calculate lost wages using your regular hourly rate or salary, and obtain letters from supervisors confirming missed time and its cause.

If harassment leads to job loss or impacts your ability to seek new employment, document these consequences thoroughly. Some harassment victims experience such severe stress that they cannot maintain steady employment, creating ongoing economic damages that extend far beyond the initial collection period.

Credit Report and Financial Standing Damage

Harassing debt collectors sometimes report false information to credit bureaus or fail to validate debts properly, causing additional financial harm. Obtain copies of your credit reports before, during, and after the harassment period to document any negative impacts on your credit score or borrowing ability.

Calculate the financial impact of credit damage, including higher interest rates on loans, denied credit applications, or required security deposits for utilities or housing. The Consumer Financial Protection Bureau recognizes these as legitimate damages from collector misconduct.

Costs of Addressing Harassment

Keep records of expenses incurred in responding to debt collection harassment, including phone bills for calls to attorneys, postage for cease and desist letters, or costs of obtaining credit reports. While these might seem minor individually, they accumulate significant damage over time.

Document any costs of changing phone numbers, addresses, or other personal information to avoid continued harassment. Some victims incur substantial expenses relocating or modifying their contact information to escape persistent collectors.

Common Evidence Mistakes That Weaken Cases

Understanding what strengthens harassment cases is essential, but avoiding common evidence mistakes is equally crucial. The Federal Trade Commission has identified several recurring problems that can undermine otherwise strong harassment claims.

Inconsistent Documentation

Gaps in documentation or inconsistent record-keeping can raise questions about the reliability of your evidence. Collectors’ attorneys will look for discrepancies between accounts of the same incident or periods where documentation suddenly becomes more detailed, suggesting reconstruction rather than contemporaneous recording.

Maintain consistent documentation standards throughout your interactions with collectors. If you begin keeping detailed records only after consulting with an attorney, acknowledge this timeline rather than trying to recreate earlier incidents from memory.

Emotional Rather Than Factual Records

While emotional impact is essential in harassment cases, your documentation should focus primarily on objective facts rather than subjective interpretations. Record what was said and done, not just how it made you feel, as courts need concrete evidence of collector misconduct.

Balance emotional impact documentation with factual records that establish clear FDCPA violations. The most compelling cases combine objective evidence of illegal conduct with credible testimony about its effects.

Inadequate Preservation Methods

Evidence that becomes corrupted, lost, or altered loses its value in legal proceedings. Use reliable preservation methods and create multiple backup copies of crucial evidence. The Consumer Financial Protection Bureau recommends storing evidence in formats that maintain integrity over time and can be easily authenticated in court.

Building Your Timeline: Organizing Evidence for Maximum Impact

The most compelling harassment cases present evidence in a clear, chronological format that demonstrates escalating misconduct over time. Organize your evidence to tell a story that judges and juries can easily follow and understand.

Create a master timeline that integrates all forms of evidence, phone logs, recordings, written communications, witness statements, and damage documentation. This comprehensive view helps identify patterns of harassment and demonstrates the cumulative impact of collector misconduct.

Consider working with an attorney experienced in FDCPA litigation to organize and present your evidence effectively. The Consumer Financial Protection Bureau notes that cases with strong evidentiary foundations are more likely to result in favorable settlements, often avoiding the time and expense of trial.

Conclusion

Building a winning debt harassment lawsuit requires systematic evidence gathering, careful documentation, and strategic organization of case materials. The difference between a successful claim and a dismissed lawsuit often lies not in the severity of the harassment but in the quality of the evidence presented to prove it.

Remember that debt collectors and their attorneys are experienced in defending harassment claims and will challenge your evidence’s authenticity, relevance, and impact. By maintaining contemporaneous records, preserving communications properly, and documenting both objective violations and subjective effects, you create a comprehensive case that’s difficult to refute.

Proper evidence gathering pays dividends in potential court victories and more substantial settlement negotiating positions. Collectors faced with well-documented harassment claims often prefer to settle rather than risk jury trials that could result in significant damages and attorney fee awards.

Suppose you’re dealing with debt collection harassment and need professional guidance on building your case and protecting your rights. In that case, CPG Complete has extensive experience helping consumers navigate debt collection violations and FDCPA claims. Our team understands the evidence requirements for successful harassment lawsuits and can help you document violations while working toward the resolution of your underlying debt issues. We know that debt collection harassment not only violates your legal rights but can cause severe emotional and financial harm to you and your family. Contact us today to learn how we can help you build a strong case against harassing debt collectors while exploring comprehensive solutions to your debt challenges.